US citizens or residents who are beneficiaries of foreign trusts must follow complex tax reporting requirements. Below are answers to frequently asked questions on the topic of US taxation of foreign trusts.

What Information Will Your Tax Advisor Need?

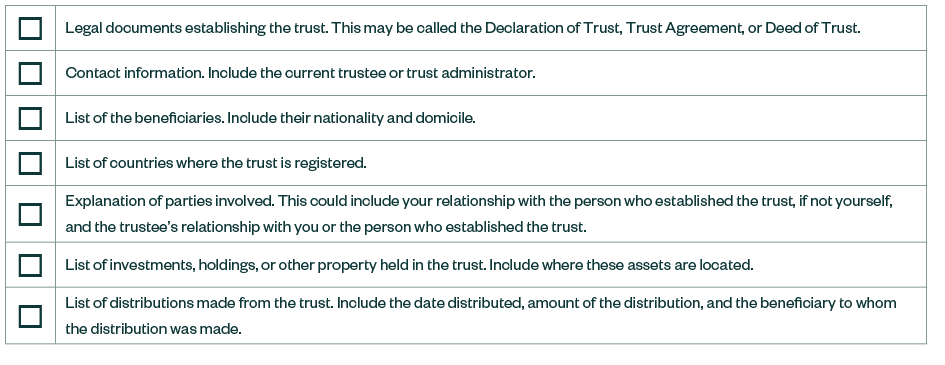

You should seek the assistance of a qualified US tax advisor who has experience advising US beneficiaries of foreign trusts. Before meeting with your advisor, you should collect some key information that will help your advisor evaluate your unique facts as noted below.

Can This Legal Arrangement Be Considered a Foreign Trust for US Tax Purposes?

Your advisor can help you determine if the legal arrangement in question should be treated as a trust for US tax purposes, which isn’t always straightforward considering how different countries may interpret the definition of a trust. These foreign legal arrangements must be evaluated under the parameters of the US definition of a trust. Classifying the trust as either a US or foreign trust is essential for determining the proper reporting required.

Once you’ve determined that the legal arrangement is a trust for US tax purposes, the next step is to consider whether the trust should be considered a domestic or foreign trust.

If a trust fails one of two tests—the court test and the control test—it’s considered a foreign trust. These tests are solely a construction of US law and are independent of any foreign classification of a trust.

Court Test

The court test looks to whether the trust is legally established or registered in the United States.

Control Test

The control test looks to the residency of the individuals who control the trust.

If it fails either the court test or the control test, then it should be considered a foreign trust. Whether the trust is considered a foreign or domestic trust for any other purpose, such as under foreign law, is irrelevant.

Who Controls the Foreign Trust?

If you’ve established that the legal arrangement is a foreign trust for US tax purposes, you should also evaluate the extent to which a US person retains decision-making authority over the foreign trust.

A US person’s authority over a foreign trust can significantly alter how the trust should be treated. For example, the level of decision-making authority a US person has over the trust will factor into whether the income of the trust should be taxed currently to US beneficiaries or when distributed to the US beneficiaries.

If you’re working with a US tax advisor, they may want to discuss the trust’s administration with the trustee to evaluate the level of decision-making authority US persons retain over the trust’s administration.

What Assets Does the Foreign Trust Own?

US income tax and reporting requirements for foreign trusts and their US beneficiaries can vary depending on the types of assets that are owned by the foreign trust.

Most foreign trusts with US beneficiaries should expect that the US beneficiary or the foreign trust will be required to file Form 3520 and Form 3520-A. The specific reporting requirements will vary depending on the specifics of the foreign trust and whether the foreign trust is controlled by US persons.

In addition to Forms 3520 and 3520-A, US beneficiaries may be required to report the assets held within the foreign trust in the following international information returns.

Reporting Additional International Information

Foreign Financial Asset Reporting

US beneficiaries may be required to include the assets of the foreign trust in their US FBAR (FinCEN Form 114) or Form 8938 – Statement of Specified Foreign Financial Assets.

Passive Foreign Investment Companies

US beneficiaries often find that investments of the foreign trust, especially mutual fund investments, are subject to the Passive Foreign Investment Company (PFIC) regime.

The US beneficiary may be required to file Form 8621 – Information Return by a Shareholder of a Passive Foreign Investment Company or Qualified Electing Fund with their income tax return and additional income taxation rules may apply.

Foreign Partnerships

If the foreign trust has invested in a foreign partnership, the US beneficiary may be required to file Form 8865 – Return of US Persons with Respect to Certain Foreign Partnerships.

Foreign Corporations

If the foreign trust has invested in a foreign corporation, they may also be required to file Form 5471 – Information Return of US Persons with Respect to Certain Foreign Corporations or Form 926 – Return by a US Transferor of Property to a Foreign Corporation.

Importance of Tax Analysis

Understanding how a type of entity is classified under US tax principles—such as, a foreign corporation or foreign partnership—is important. Similar to above where a legal arrangement is found to be either a US trust or a foreign trust, the type of entity must be determined under US tax law Any local country tax characterization will usually be irrelevant to making this determination.

Completing the required US tax analysis of the trust and its investments can be time consuming and the consequence of errors could be high. Many of the informational forms noted above have $10,000 plus per year penalties for a missed or improper filing. The filings may be required for a US beneficiary who has never received a distribution from the foreign trust.

What Can You Do to Simplify and Identify Opportunities for Tax Planning?

The options available to you to modify the US tax implications to US beneficiaries depend on the extent to which you can make changes to the administration or legal status of the trust.

If you don’t have decision-making authority over the trust, you may still be able to influence the trustee to make changes for the benefit of US beneficiaries. Note the following things that you can do to streamline complexities for US beneficiaries.

- Modify the types and timing of distributions from the foreign trust. Consider the tax implications of distribution of trust corpus versus distribution of trust income.

- Modify the types of assets held by the trust. Considerations could include trading growth stocks versus dividend paying stocks, directly holding shares of individual stocks versus shares of foreign mutual funds or shares of US mutual funds versus foreign mutual funds.

- Split the assets of the trust. Divide the trust’s assets between those held for US beneficiaries and those held for foreign ones.

- Convert the US beneficiary’s portion of the trust to a US trust. This can be done to the extent allowable under the terms of the legal document that established the trust.

Tax Planning Implications

You should evaluate the tax implications of your beneficial interest in a foreign trust as early as possible and as a part of your overall estate planning. Developing a tax plan with a qualified US tax advisor can help you mitigate the risk of thousands of dollars in penalties from missed tax filings and limit or eliminate double taxation of income earned by the foreign trust.

We’re Here to Help

For assistance with tax planning strategies for US taxation of foreign trusts or other International Tax Services, contact your Moss Adams professional.